Employment contract and international mobility

Thématiques

Date de mise à jour

Is working in France a possibility? If so, what are its framework and objectives ? How will it affect the contractual relationship between the employee and their foreign-based employer?

These are all questions that must be addressed before coming to France, to get a clear picture of how undertaking an assignment in France will impact on the employee’s employment contract.

Framework for professional mobility

Understanding the framework of this mobility in France is crucial. When an employer decides to assign a mission in France to one of their employees, they can choose from the following options

- Seconding an employee to France to carry out a temporary assignment. In the case of a secondment, the contractual relationship between the foreign-based employer and the employee in France continues uninterrupted.

A secondment may be arranged in the following circumstances:- When a foreign company is providing an international service to a company based in France, under a commercial contract.

- As part of an intra-corporate mobility program, where the employee is seconded to a French company belonging to the same group of companies as their own.

- On the employer’s own behalf, i.e. there is no client company or host company in France (e.g. participation in seminars, training, events, etc.).

- Under a secondment contract between a foreign temporary employment company (temping or placement agency) and a client company based in France.

- Expatriating an employee to France on a more permanent basis. In the case of expatriation, the original employment contract is terminated or suspended. The expatriate employee is regarded as an employee of the company in France where they work.

Understanding the difference between secondment and expatriation

Secondment

An employee is considered to have been seconded when their employer is registered outside France and entrusts them with a temporary assignment that must be carried out on French territory.

The employment contract between seconded employees and their original, foreign-based employer continues during the secondment period. They receive instructions from their original employer, which has the authority to monitor their performance or indeed to sanction any shortcomings.

Employers (and contracting parties) must comply with the regulations applicable to all workers in France (minimum wage, overtime compensation, legal working time, workplace health and safety legislation, etc.).

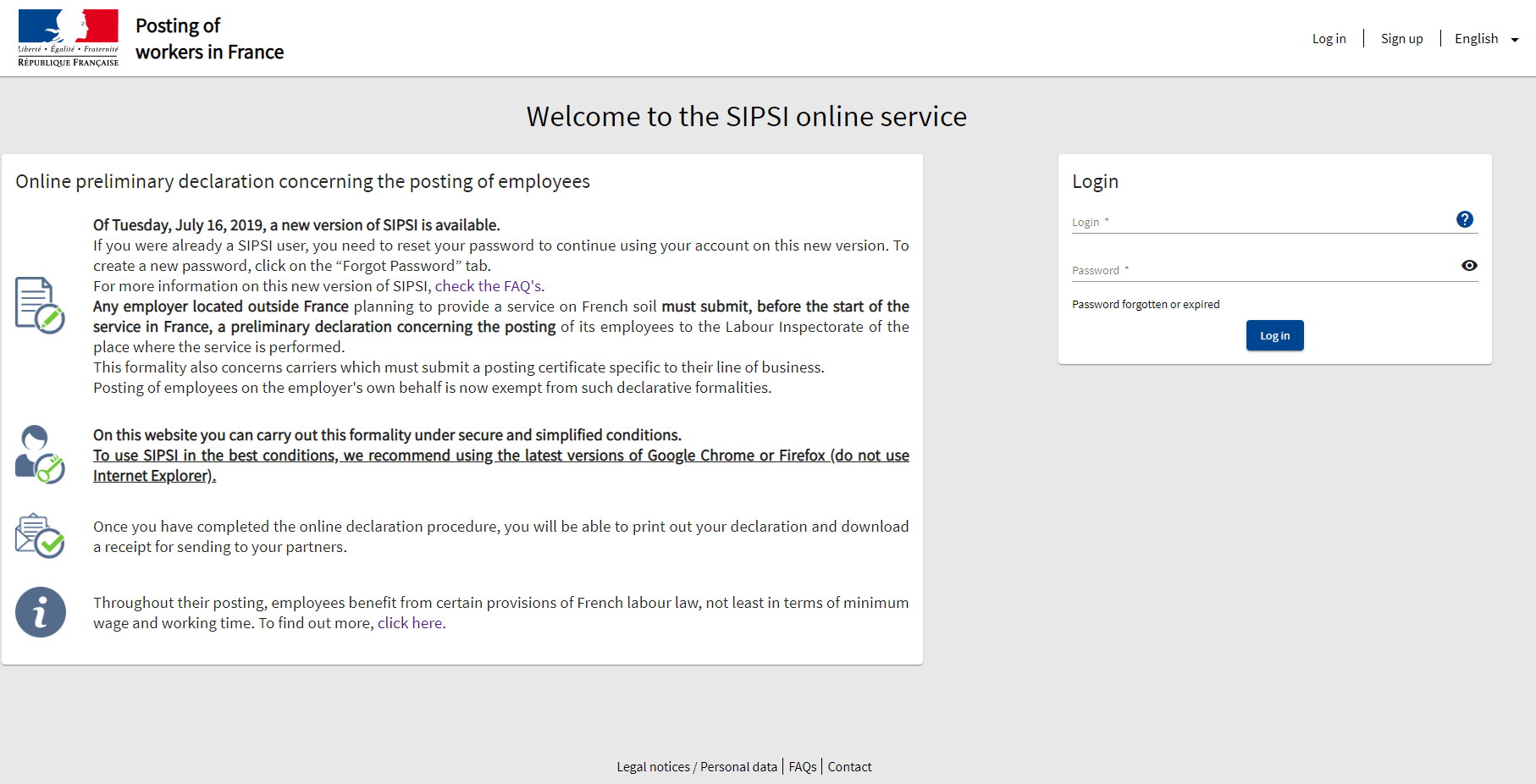

Important information: When an employee is posted to France, regardless of their nationality, their foreign-based employer must submit a secondment declaration via the Ministry for Labor’s online “Sipsi” service

Expatriation

Expatriation refers to a situation in which an employee is transferred to a company in France from a foreign company belonging to the same group.

Thus, expatriate employees in France are employed by the French subsidiary of a group of companies. The company in France becomes their sole employer.

Impact on the employment relationship

| Secondment | Expatriation | |

| Employment contract |

Original employment contract continues with the foreign-based company Secondment amendment specifying the scope of the assignment in France |

Original employment contract terminated or suspended

Employment contract under French law concluded with the host company in France |

| Length of the assignment in France | Assignments are, by nature, limited in time | Indefinite term |

| Subordination relationship with the original employer | Continued | Suspended or terminated |

| Law applicable to the employment relationship |

Labor law of the country of origin and Provisions of the French Labor Code and collective agreements, relating in particular to the following areas: At the end of the 12th month of the secondment, the employer must comply with the full extent of French labor law, with the exception of certain provisions, such as those related to the formation and termination of the employment contract |

French labor law See our labor law fact sheets |

| Labor law formalities |

Amendment to the original employment contract When an employee is posted to France, regardless of their nationality, the foreign-based employer must submit a secondment declaration via the Ministry for Labor’s online «“Sipsi” service». Appointment of a representative in France e See the file onthe posting of workers on the Ministry for Labor’s website |

French employee subject to French law, requiring the conclusion of a new employment contract with the company in France

Compulsory declaration prior to recruitment (Déclaration préalable à l’embauche – DPAE) See our recruitment fact sheet |

| Remuneration |

Paid by the original company At a minimum, seconded employees must receive the same remuneration as local employees, not the minimum remuneration – “equal pay for equal work” |

Paid by the host company |

| Residence permit for non-EU, EEA and Swiss nationals |

For intra-corporate secondments: residence permits for “ICT seconded employees” and “ICT seconded (mobile) employees” For other secondments: “Temporary employee” and prior work authorization See our fact sheet on residence permits for seconded employees |

"Talent"status, particularly the “Employees on assignment” category Any other residence permit authorizing salaried employment See our fact sheet on residence permits for employees recruited in France |

| Social security implications |

Intra-community secondment: continued affiliation to the original social security system -> Prior request for forms A1 and S1 Secondment under a bilateral social security agreement -> Prior request for a secondment certificate Secondment without a social security agreement -> Affiliation to the French social security system See our fact sheets on the social protection of seconded employees |

Affiliation to the French social security system See our fact sheets on the general social security scheme |

| Personal taxation implications |

Expatriate or seconded status has no effect on an employee’s tax residency or personal taxation. To learn more about tax residency and taxation procedures, see our fact sheets on personal taxation. |

Expatriate or seconded status has no effect on an employee’s tax residency or personal taxation. To learn more about tax residency and taxation procedures, see our fact sheets on personal taxation. |